Financial institution and banks have been an integral part of the economy. The founding principle on which financial institutions and banks have operated on is trust. Trust that they will safeguard your money, trust that they will work what’s best for the people. Now with developments occurring at such a rapid pace and the advent of the blockchain technology there seems to be a paradigm shift from the traditional practices to newer and advanced technologies.

Blockchain is a technology that allows people to create a platform where multiple users come together to create a financial ledger that records transactions from the very initial transactions thereby creating a block of transactions which allows every participant to inspect them, but it’s not in the control of a single user .

This creates a twofold advantage for the member as it provides transparency and does not require the participants to trust or even know of each other. Blockchain is slowly and steadily building a reputation as one the trusted sources of investment. One of the factors contributing to that is Bitcoin, as blockchain is the technology behind Bitcoin The success and acceptance of Bitcoin has made everyone more aware of the technology behind it.

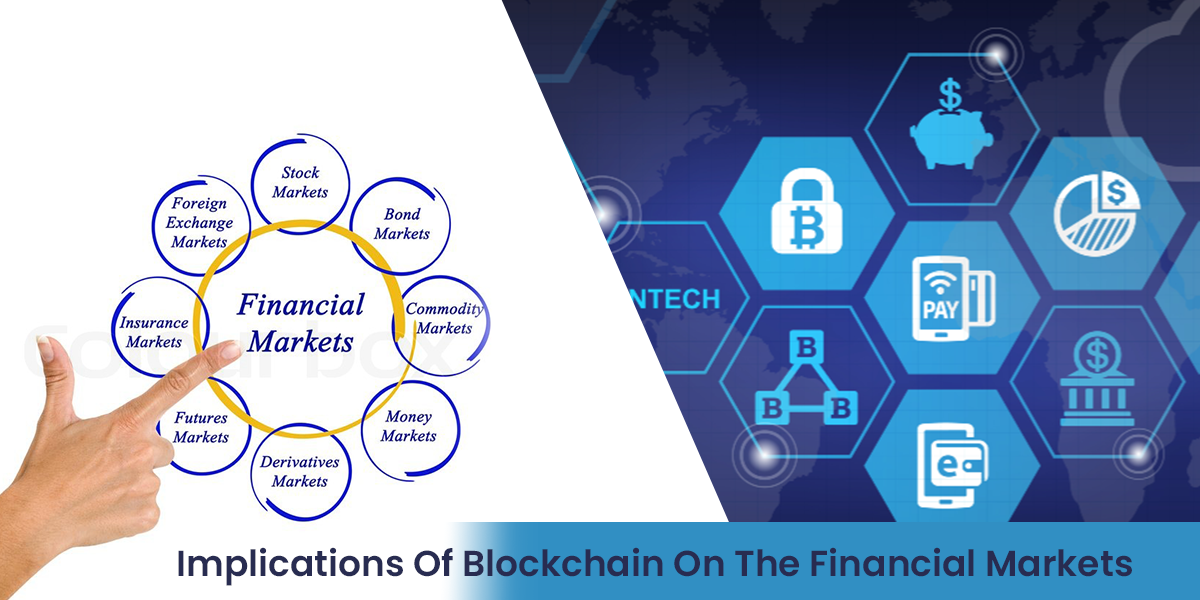

Blockchain as a technology is gaining popularity day by day and now a lot of businesses are considering investing in this technology, this is going to impact financial markets.

Impact on financial Markets:

Disruption in conventional practices:

Banks have been the link between those who have funds and those who need these funds. But with advent of blockchain technology this practice seems to be changing. As blockchains does not require an arbitrator to facilitate transactions between them. this has brought about a drastic shift in the borrowing and lending of money. As more and more people look towards blockchain as an investment strategy banks and financial institutions need to upgrade their traditional practices. And traditional practices need to now make way for new practices.

International Appeal

Businesses are growing they are no more limited by geographical boundaries. As businesses have cross border transactions, it should also be kept in mind how they will make and receive payments. Banks and other financial institutions usually charge high rates for such transactions. Also, the time for these transactions to go through is 5-7 days. But the blockchain technology offers a more efficient way to conduct these transactions and at a lower rate as well. This will have an impact of the financial markets as they will enable a more efficient and inexpensive way of conducting transactions.

Transparency:

Financial institutions have always been burdened by not being very transparent and being ambiguous in nature. With blockchain technology and application development this is going to change. Blockchain technology is extremely transparent is nature as the players involved in this can view the transactions and the history is recorded and there is no way these transactions can be tampered or altered with it. This will directly impact the financial institutions as they will need to be clearer and more transparent when it comes to their transactions.

Security:

Blockchain technology and applications are constantly looking to improve and upgrade their applications and developers are constantly looking find solutions to challenges that may arise. One threat financial institution always face is that of lack of security of transactions. Blockchain technology is extremely safe as no one can tamper or modify the transactions. Banks and financial institutions are looking into developing probable blockchain solutions to overcome this threat.

Increased productivity:

Blockchain applications allow users to transact with each other directly without using any middlemen and arbitrators to facilitate the transactions. This has enabled them to increase their efficiency as decisions can be take faster and no outsider can play a role influencing the decision-making process, thus as and when the potential arises that requires immediate action it can be implemented. This has enabled in increased productivity as well.

Conclusion:

Blockchain as a technology is still in its initial stages, the applications need to be developed and they still have a long way to go, as awareness about this technology needs to increase. Financial institutions and markets are investing in the development of blockchain technology, this in turn increases the demand for skilled blockchain developers. Financial institutions and markets are looking forward to completely integrate this technology in the day to day transactions as it will increase their efficiency and lower transaction costs. This will bring about a change in the financial markets and how they function, monopoly and dependency will reduce and will give all the participants a level playing field. This will cause a drastic shift in transforming the rules and setting up new set of rules.